main street small business tax credit reddit

Beginning on November 1 2021 and ending November. If credits were received prior for the first version of the main street small business tax credit they would be.

Hardship Grants Small Business Development Corporation

We have the experience and knowledge to help you with whatever questions you have.

. Provide the confirmation number received from CDTFA on your. Hopefully there is something in this for you. Get the tax answers you need.

Each employer is limited to no more than 150000 in credit. A small business according to the SBA can have 1500 employees and do 20mil a year. The program allows a small business hiring.

The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. The cap on the credit is 150000 for each qualified small business employer. Press J to jump to the feed.

We have the experience and knowledge to help you with whatever questions you have. Please dont forget that small business is still not actually small business in the US. The amount of credit you may receive for the 2021 taxable year is reduced by the Main Street Small Business Tax Credit for.

The Main Street Small Business Tax Credit II will provide COVID-19 financial relief to qualified small business employers. California Main Street Small Business Tax Credit II Marcum. What is the maximum amount of credit allowed per each qualified small.

Main street small business tax credit ca. Your Main Street Small Business Tax Credit will be available on April 1 2021. Californias governor signed senate bill 1447 establishing the main street small business tax credit.

Provide the confirmation number received from CDTFA on your. California Establishes Main Street Small Business Tax Credit Overview Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. Ad Talk to a 1-800Accountant Small Business Tax expert.

These will be offered by member banks at some point With a minimum loan amount of 500k and max of 4xIBITDA these loans will probably be pretty difficult to get - youll have to show. On November 1 2021 the California Department of Tax and Fee. File your income tax return.

The credit is for California businesses impacted by recent economic disruptions resulting from COVID-19 To. Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog Details Of Simple Invoice. The amount of credit you may receive for the 2021 taxable year is reduced by the Main Street Small Business Tax.

Scott Hauge President Small. Here we can discuss the Feds own Main Street Lending Program talk about other potential avenues of financing and how to. The Main Street Small Business Tax Credit is calculated based on monthly full-time employees.

2021 Main Street Small Business Tax Credit II CDTFA CAgov From November 1 2021 through November 30 2021 California Qualified Small Business Employers. The new tax credit program provides financial relief to qualified small businesses for economic disruptions in 2020 and. Main street small business tax credit ca Monday June 6 2022 Edit.

Each employer is limited to no more than 150000 in credit. Funding for the Small Business Hiring Tax Credit program totals 100 million and is to be allocated to qualified California small business employers. Get the tax answers you need.

You will be able to apply your credits against your sales and use tax liabilities for reporting periods starting with. Include your Main Street Small Business Hiring Credit FTB 3866 form to claim the credit. The Main Street Small Business Tax Credit is Back for 2021 California enacted legislation for the Main Street Small Business Tax Credit II on July 16 to assist businesses impacted by the.

Ad Talk to a 1-800Accountant Small Business Tax expert. Generally these employers may. Main Street Small Business Tax Credit II Dont forget to claim it.

File your income tax return. Senate Bill 1447 was enacted on September 9 2020 and. Include your Main Street Small Business Hiring Credit FTB 3866 form to claim the credit.

You can find more information on the Main Street Small Business Tax Credit Special Instructions for Sales and Use Tax Filers page. January 2021 Tax News Times running out for the Main Street Small Business Tax Credit The Main Street Small Business Tax Credit is for employers affected by the economic disturbances. Please see below a complete list of small business tax credits mostly attributed to the Jobs bill.

As Pandemic Aid Was Rushed To Main Street Criminals Seized On Ppp Eidl

G20 Signs Off On 15 Global Minimum Corporate Tax Here S How It Will Work

As Pandemic Aid Was Rushed To Main Street Criminals Seized On Ppp Eidl

R D Tax Credits Are Due July 15 Neo Tax Wants To Help Startups Apply And Raised 3m To Do It Techcrunch

Addressing Zimbabwe S Inflation The Role Of The Digitalization Of Financial Transactions

Customers Can Spend Bitcoin At Starbucks Nordstrom And Whole Foods Whether They Like It Or Not

Why Main Streets Are A Key Driver Of Equitable Economic Recovery In Rural America

As Pandemic Aid Was Rushed To Main Street Criminals Seized On Ppp Eidl

Hardship Grants Small Business Development Corporation

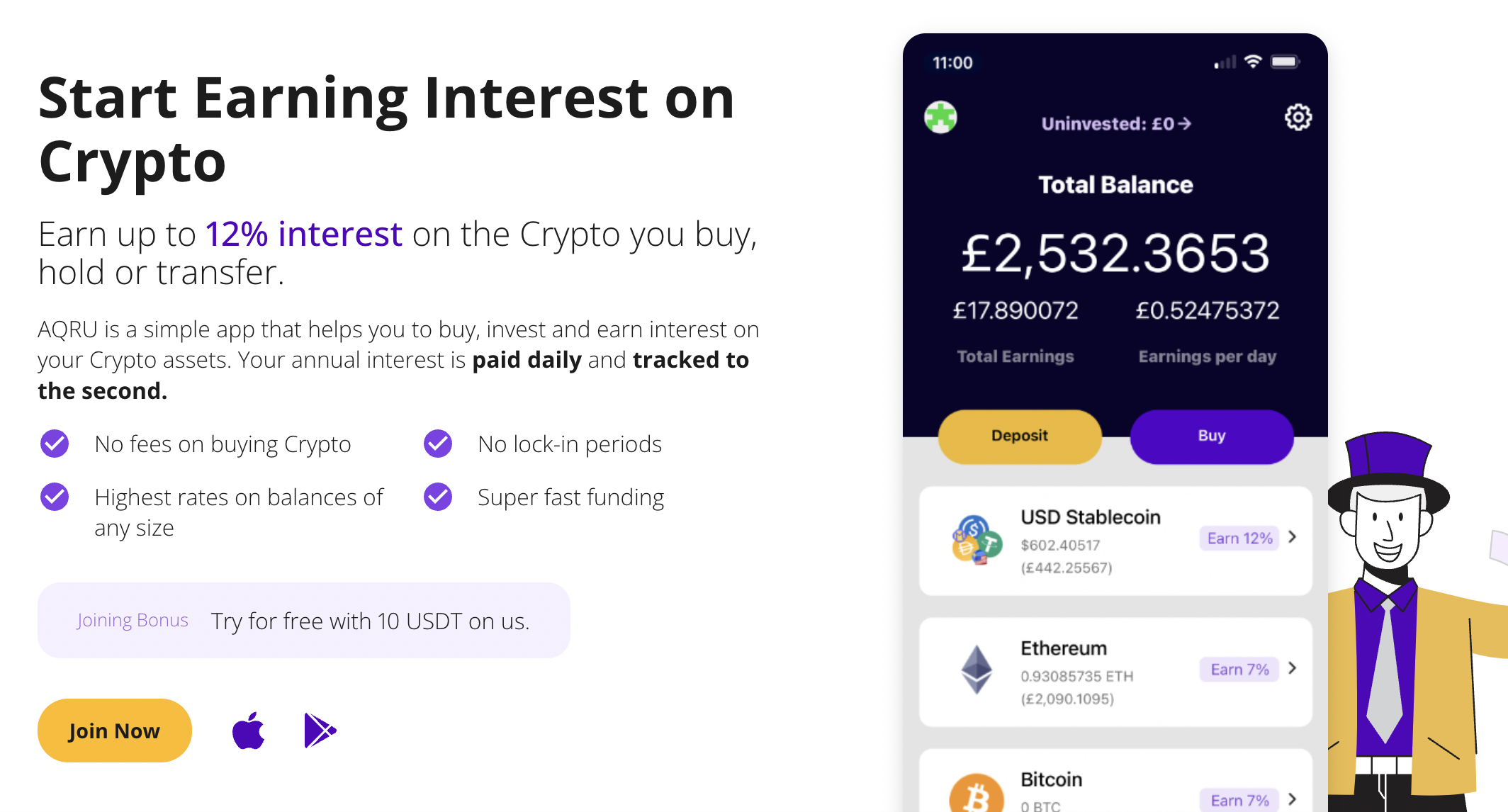

Best Crypto Bank Accounts In 2022 Top 5 Bitcoin Banks Compared

Addressing Zimbabwe S Inflation The Role Of The Digitalization Of Financial Transactions

Selling On Etsy Your Taxes Turbotax Tax Tips Videos

Business Tax Deadline In 2022 For Small Businesses

Cdc Small Business Finance The Nation S Top Sba Lender

2021 Legislative Bills And Hearings Breakdown Noise

Addressing Zimbabwe S Inflation The Role Of The Digitalization Of Financial Transactions