student loan debt relief tax credit 2020

Pay off Credit Card Debt. Practical Suggestion for Tax Refund.

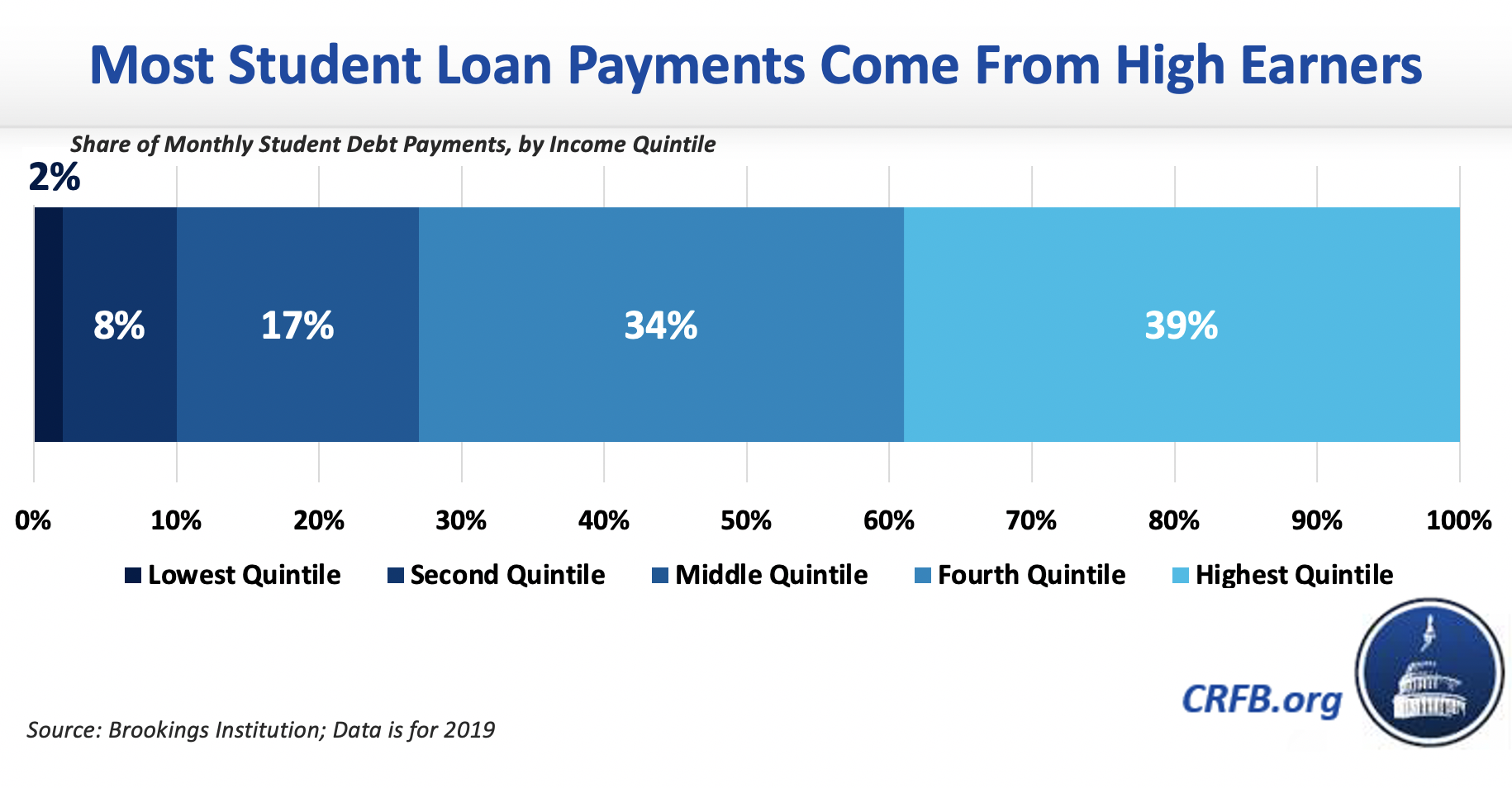

Who Owes The Most Student Loan Debt

Pay off Credit Card Debt.

. If youre looking for student loan debt relief the answer might be. Refundable credits are paid out in full no matter what your income or tax liability. Universities in 2020 owed an average of 45000 in student loan debt.

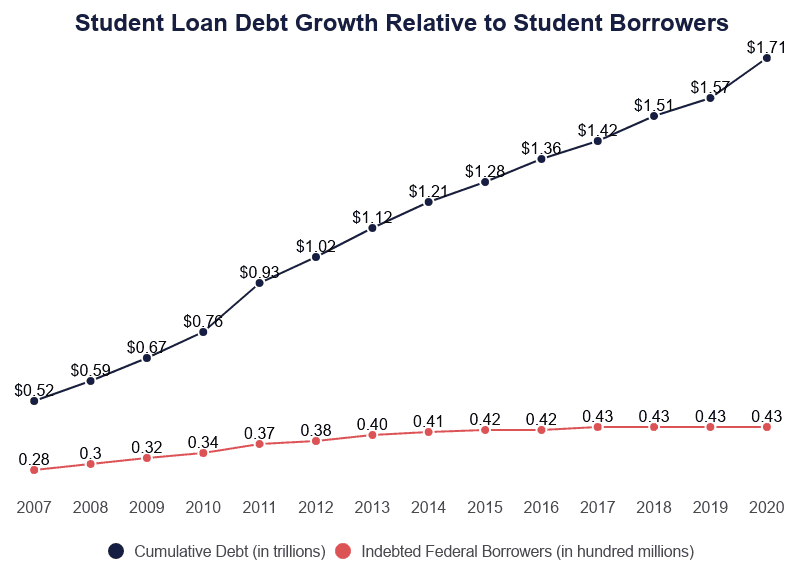

How Can to Apply for a CTU Student Loan Discharge or Refund. The skyrocketing cumulative federal student loan debt16 trillion and rising for more than 45 million borrowersis a significant burden on Americas middle class. How the New FICO Credit Scoring System Will Affect You January 29.

Millions of borrowers faced once again handing over 300 a month or even more to cover their federal student loan debt beginning Sept. If you notice something out of place voice your concern as soon as possible and ask questions if youre unsure about what you. How to Qualify for the ITT Tech Lawsuit Student Loan Forgiveness Program.

If that happens you might want to reconsider whether a debt consolidation loan with bad credit is the right debt-relief option for you. Close 866 612-9971 866 612-9971. President Bidens move means the student loan balances of millions of people could fall by as much as 20000.

2020 Guide to 401k Matching for Student Loan Debt Payments. Information advertised valid as of. In general you must report any taxable amount of a canceled debt as ordinary income from the cancellation of debt on Form 1040 US.

UPDATED March 28th 2020. Send any friend a story As a subscriber you. They were also obliged to contact affected students by mail to inform them about the loan status and credit report changes.

Should I Apply for a New Credit Card During COVID. Student loan forgiveness is now tax-free. Heres some more good news.

This would include Public Service Loan Forgiveness PSLF and LRAPs like the Student Loan Relief. Individual Income Tax Return Form 1040-SR US. A financial or credit institution or an insurance company that is subject to examination and supervision by an agency of the US or any State.

If you dont want to pursue a BDAR. Tax Return for Seniors or Form 1040-NR US. Rental Assistance Programs.

In short this ITT Tech lawsuit update was a great debt relief chance for approximately 35000 students. UPDATED Tuesday March 24th 2020. May be to closely monitor your credit report and your student loan repayment process for errors.

The 19 trillion stimulus package passed in March 2021 also known as the American Rescue Plan made student loan forgiveness tax-free through 2025. Across the United States 45 million people owe 16 trillion for federal loans taken out for college more than they owe on car loans credit cards or. Practical Suggestion for Tax Refund.

Examples include the earned income tax credit EITC child tax credit and the American Opportunity Tax Credit. Sallie Mae loans are made by Sallie Mae Bank. Based on a comparison of approval rates for Smart Option Student Loan for Career Training borrowers who applied with a cosigner versus without a cosigner from May 1 2020 through April 30 2021.

The ITT Technical Institutes announced the closure in 2016 in 38 states. Explains how it will work. Trim your bill by up to 2000 for each qualifying minor child in your household.

Nonresident Alien Income Tax Return as other income if the debt is a nonbusiness debt or on an applicable schedule. From Day One the Biden-Harris Administration has been committed to making student loan relief programs work for everyone including by addressing failures that deny borrowers the benefits they earned. Close 866 612-9971 866 612-9971.

Efforts to revise IDR regulations will produce substantially more affordable monthly payments for millions of borrowers. 2020 Guide to Student Loan Interest Tax Deductions. If you attended the Colorado Technical Institute CTU then you may be eligible for a student loan discharge or even a full refund thanks to a lawsuit that 49 States Attorney Generals just settled with their parent company the Career Education Corporation.

If youre married you can each get 10000 forgiven if your combined income is less than 250000. 2 days agoHow much debt can I get forgiven. Pennsylvania provides tax-free status for student loan debt that is forgiven via a state or Federal program that provides for payment or cancellation of student loans when the work is done for a period of time in a specified profession as of 2021.

2020 Guide to. Companies offer the perk but 8 of companies with 40000 employees or more have it. The cap is based on adjusted gross income and calculated on your 2020 or 2021 tax return.

2020 Guide to Federal Student Loan Debt Relief Programs. A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees such as tuition books and supplies and living expensesIt may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. The departments plan contemplates that all types of federal student loans would be eligible for loan forgiveness including Grad and Parent PLUS loans as well as federal loans owned by private.

If you attended ITT Tech between 2006 and 2016 then you may qualify for ITT Tech student loan forgiveness benefits via either the The Borrowers Defense To Repayment program or the Closed School Loan Discharge program. Students who graduated from UK. Which of these tax credits apply to your situation.

Before noon Wednesday the US. The original coronavirus relief bill known as the CARES Act and signed into law on March 27 2020 helped most federal student loan borrowers by temporarily pausing payments and involuntary. By the end of March 2021 the estimated value of.

Despite campaign promises in April 2020 by then-candidate Joe Biden to forgive 10000 in student debt per borrower guaranteed student debt cancellation for most borrowers remains uncertain. Student Loan Repayment Plans. How to Get Federal Student Loan Forgiveness for Non-Profit Employees.

If youre someone earning less than 125000 you can get up to 10000 in federal student debt forgiven. President Joe Biden indicated in April 2022 that he would make a decision soon on whether to initiate this relief. The Student Loan Repayment Benefit is the name and it is being offered by employers who contribute a certain dollar amount per year toward paying off an employees student loans.

The Non Profit Student Loan Forgiveness Program offers complete Federal Student Loan Forgiveness benefits for all Full-Time 501c3 Non Profit Employees via the Public Service Loan Forgiveness Program PSLF. So far only 4 of US. Tackling Student Debt.

Chart Americans Owe 1 75 Trillion In Student Debt Statista

Is Taking On More Student Debt Bad For Students Econofact

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

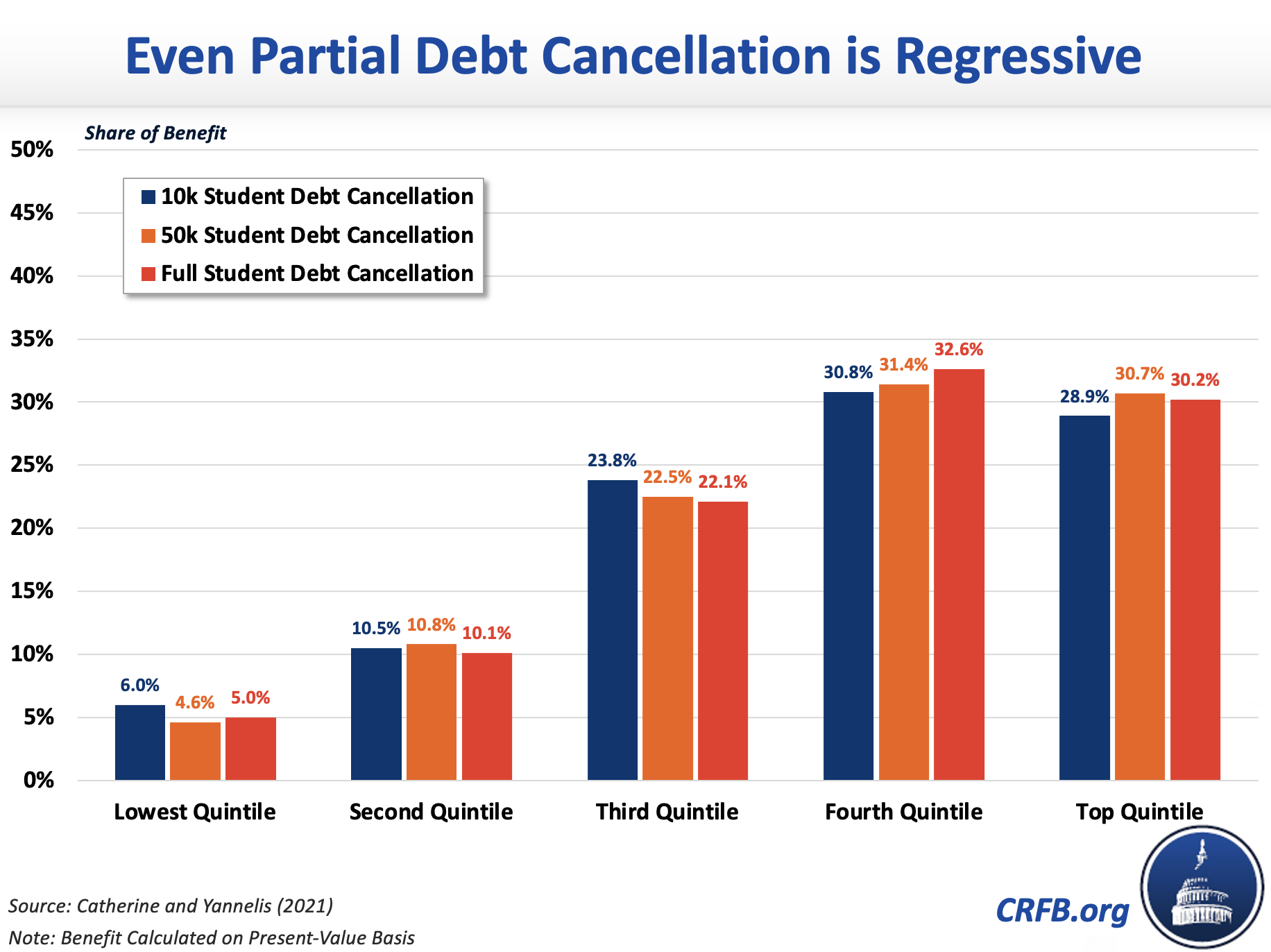

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

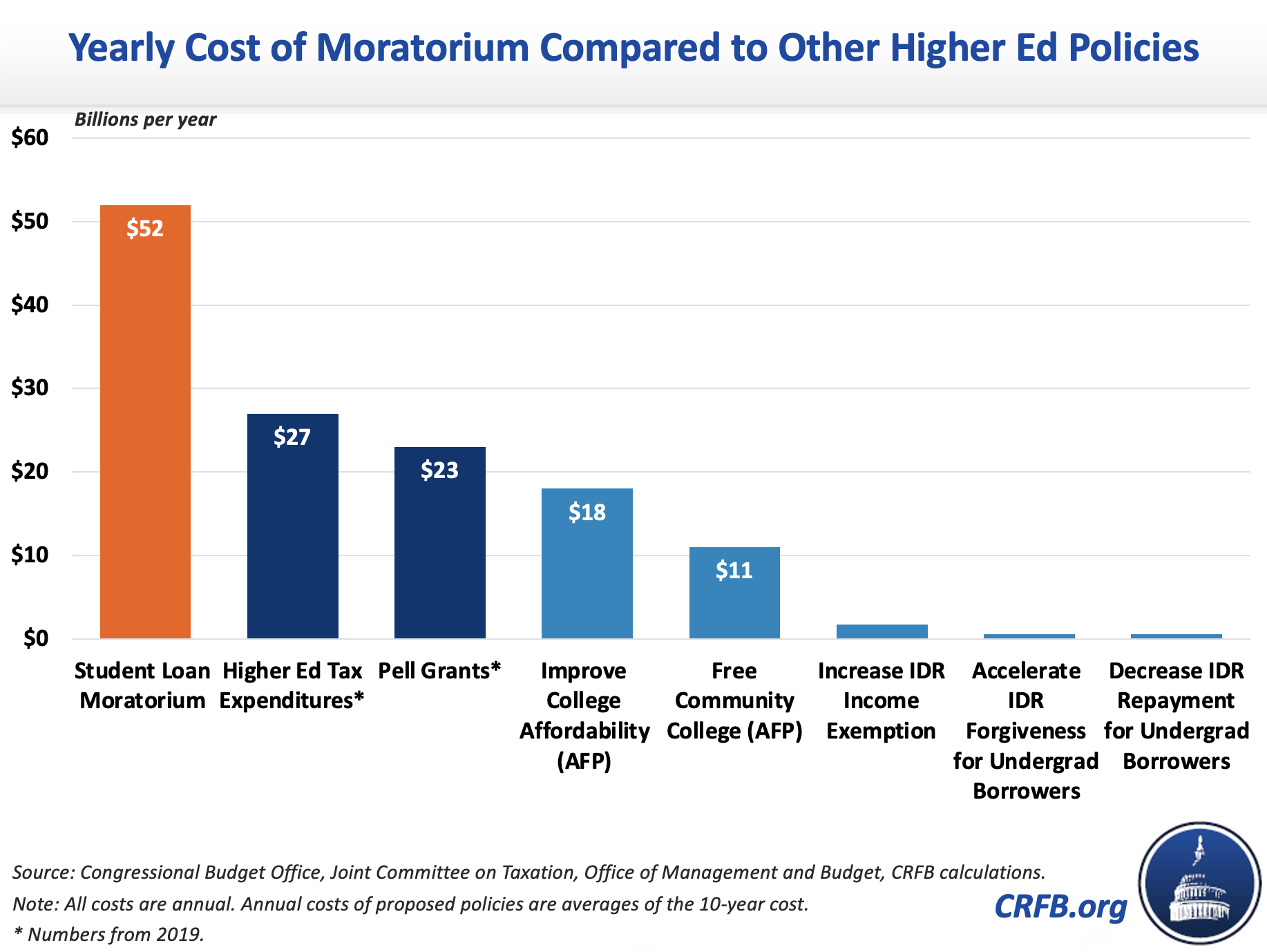

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

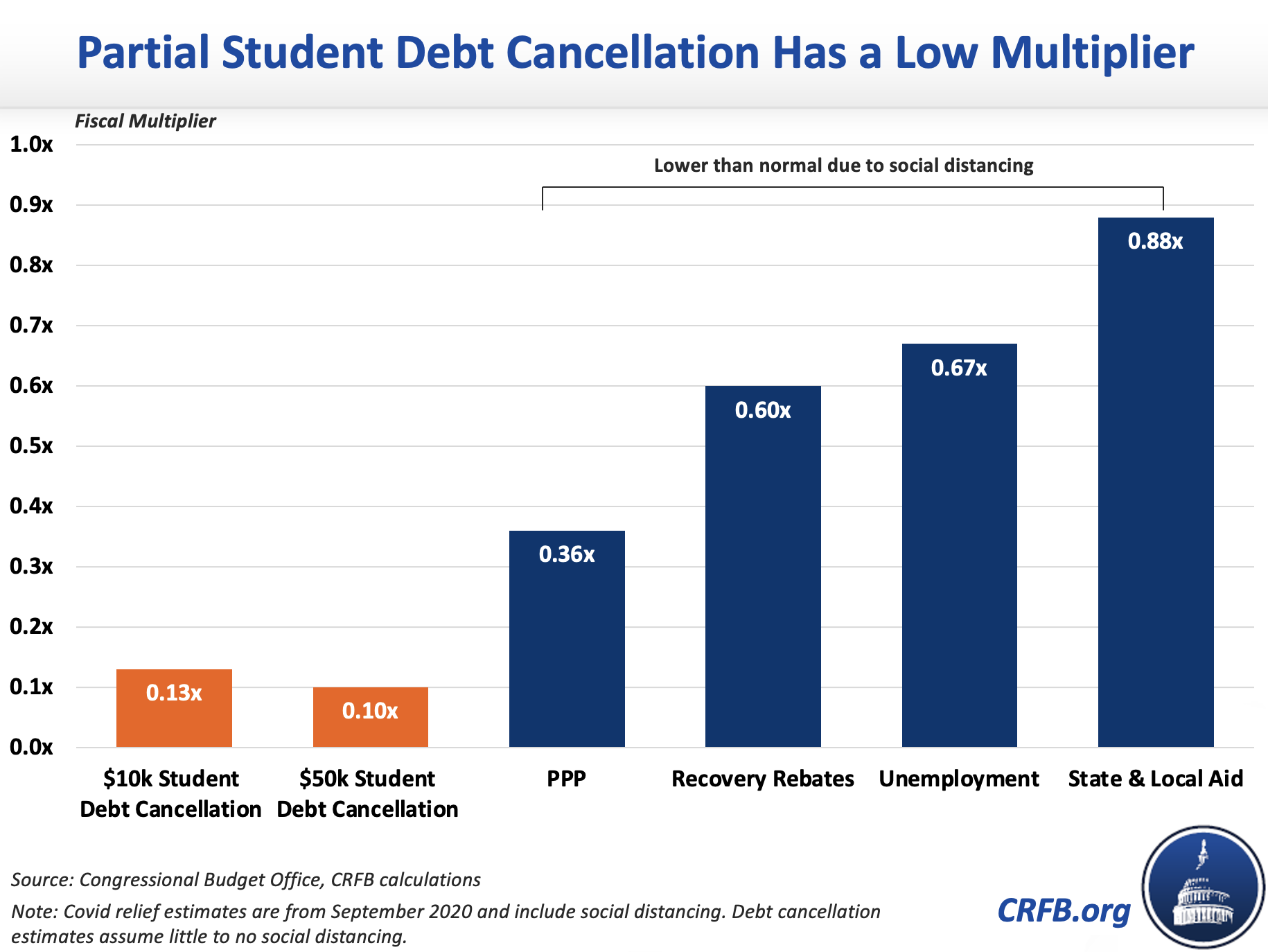

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

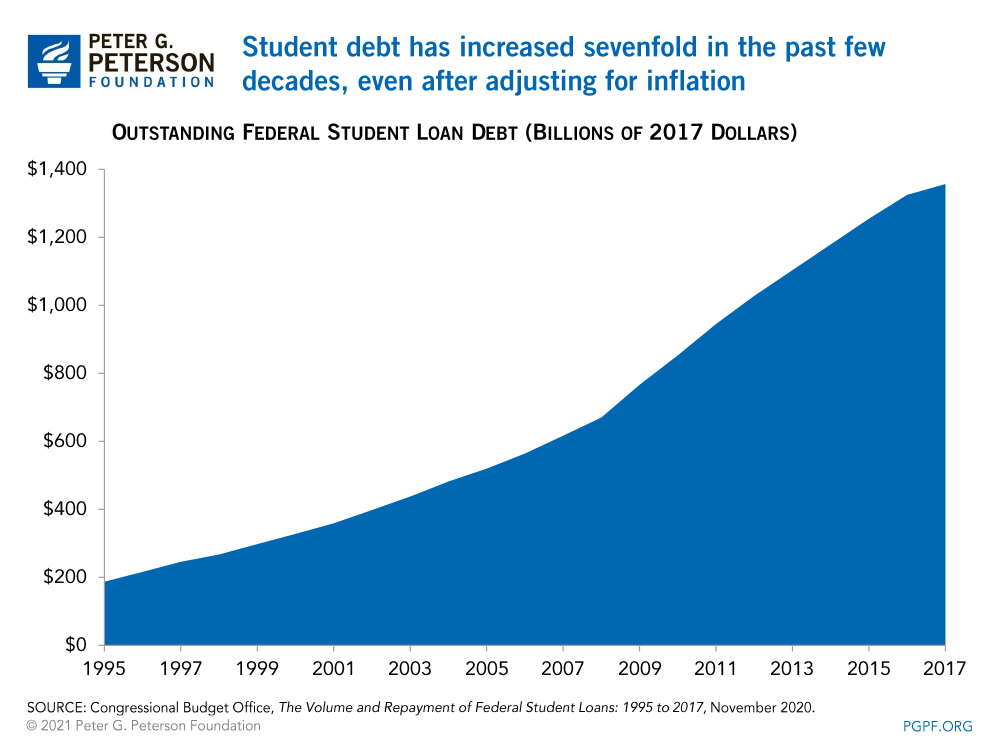

Student Debt Has Increased Sevenfold Over The Last Couple Decades Here S Why

Student Loan Forgiveness Statistics 2022 Pslf Data

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Covid 19 Relief Bill Passes With Tax Free Status For Student Loan Forgiveness

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Student Loan Debt Crisis In America By The Numbers Educationdata Org

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

What Is The Current Student Debt Situation People S Policy Project

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven